Being familiar with Margin Trading: A Comprehensive Guide for novices

Being familiar with Margin Trading: A Comprehensive Guide for novices

Blog Article

Margin trading has received substantial popularity amongst traders trying to find to amplify their profits within the economic marketplaces. Though it provides the potential for greater returns, Additionally, it comes with elevated hazards. This guidebook aims to supply a clear understanding of what margin investing is, how it really works, along with the advantages and drawbacks affiliated with it.

Exactly what is Margin Investing?

Margin trading involves borrowing resources from a broker to trade monetary belongings, for example stocks, cryptocurrencies, or commodities. This permits traders to open bigger positions than they could with their own individual funds. The borrowed money, known as margin, are generally a percentage of the full trade benefit, as well as the trader is required to maintain a specific degree of fairness within their account.

How can Margin Trading Operate?

Opening a Margin Account: To engage in margin buying and selling, you might want to open up a margin account having a brokerage agency. This account differs from a daily cash account in that it means that you can borrow money to generate trades.

Leverage: Leverage is a essential characteristic of margin investing. It refers to the ratio of borrowed funds on the trader's have funds. Such as, For those who have $one,000 as well as your broker delivers four:one leverage, you could trade up to $4,000 really worth of property.

Margin Requirements: Brokers set margin demands, which happen to be the minimum equity degrees you must maintain inside your margin account. If your account value falls beneath this degree, you’ll receive a margin phone, demanding you to definitely deposit extra resources or offer some property to protect the shortfall.

Desire on Borrowed Cash: Any time you borrow income to trade on margin, you might be required to spend desire to the borrowed total. The curiosity price varies by broker and is generally billed everyday.

Threat of Liquidation: If the worth of your respective financial commitment drops substantially, and You can not fulfill the margin get in touch with, the broker may liquidate your belongings to Recuperate the borrowed resources. This may result in substantial losses.

Professionals of Margin Trading

Amplified Getting Power: Margin buying and selling enables you to control larger sized positions, probably bringing about higher income.

Diversification: With extra cash, you are able to diversify your investments throughout various property, reducing threat.

Make the most of Market place Actions: Traders can benefit from both equally soaring and falling markets through the use of margin to brief-promote property.

Negatives of Margin Investing

Improved Chance: When margin investing can amplify earnings, it could also Enlarge losses, resulting in a quick depletion within your cash.

Desire Expenses: The fascination on borrowed cash can try to eat into your income, particularly if the trade doesn’t go as planned.

Margin Calls: If the marketplace moves from your posture, you may be required to deposit additional funds quickly to avoid liquidation.

Potential for Full Loss: In Intense situations, margin trading can result in a loss of your entire expense, and you could owe greater than your Original cash.

Is Margin Investing Best for your needs?

Margin investing is just not appropriate for everybody. It demands a deep comprehension of the marketplace, a high possibility tolerance, and the opportunity to watch your investments carefully. In the event you’re a newbie, it’s sensible to begin with a little amount and little by little enhance your publicity as you get expertise. Normally have a transparent exit strategy and under no circumstances danger in excess of you are able to find the money for to lose.

Conclusion

Margin buying and selling could be a robust tool for experienced traders, offering the prospective for higher returns. Even so, it also carries major risks that can cause considerable losses. Prior to diving into margin investing, ensure you totally recognize the mechanics, threats, and costs involved. Teach you, begin little, and take into account consulting using a monetary advisor to determine if margin buying and selling aligns using your financial investment goals.

By gaining a strong knowledge of margin trading, you can make educated conclusions and better navigate the complexities of the financial marketplaces.

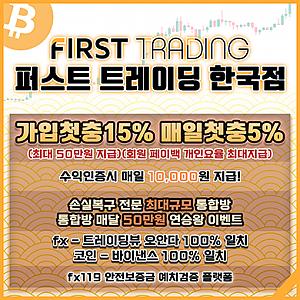

Get more info. here: fx마진거래